SoFi: Personal Loans with Low Rates and No Hidden Fees

When it comes to personal loans in the United States, SoFi has built a strong reputation for offering competitive rates, transparent terms, and fast approval processes. If you’re looking to borrow money for debt consolidation, home improvements, or unexpected expenses, SoFi stands out as a reliable choice with no hidden fees.

Why Choose SoFi for Your Personal Loan?

SoFi personal loans come with several attractive features that differentiate them from traditional banks:

- Competitive interest rates: Rates start as low as 5.99% APR, depending on your creditworthiness ([nerdwallet.com](https://www.nerdwallet.com/best/personal-loans/sofi-personal-loan-review?utm_source=chatgpt.com)).

- No origination fees: Unlike many lenders, SoFi doesn’t charge fees for processing your loan.

- Flexible terms: Loan terms range from 2 to 7 years, allowing you to pick monthly payments that suit your budget.

- Unemployment protection: SoFi offers career coaching and unemployment protection, providing some peace of mind if you lose your job ([sofi.com](https://www.sofi.com/unemployment-protection/)).

How the Application Process Works

Applying for a SoFi personal loan is straightforward and fully online. Here’s what you can expect:

- Prequalification: Check your rates with a soft credit check that won’t impact your credit score.

- Application: Provide basic personal and financial information.

- Approval and funding: If approved, receive funds as soon as the next business day.

This quick turnaround is one of the reasons SoFi is popular among borrowers needing fast access to cash ([investopedia.com](https://www.investopedia.com/sofi-personal-loans-review-5186987?utm_source=chatgpt.com)).

Use Cases for SoFi Personal Loans

- Debt consolidation: Combine high-interest credit card debts into a single loan with a lower interest rate.

- Home improvement: Fund renovations that increase your home’s value.

- Major purchases or unexpected expenses: Cover wedding costs, medical bills, or other financial surprises.

Customer Experiences

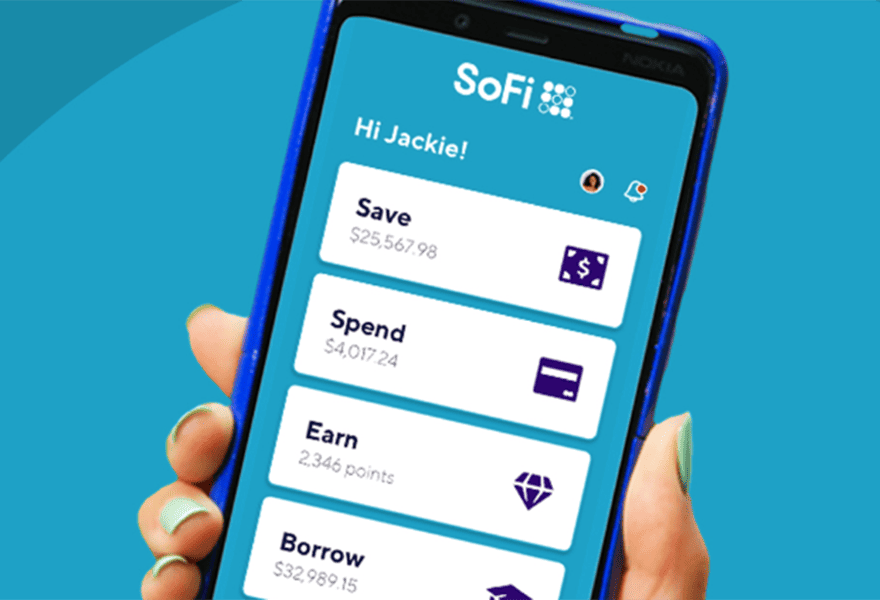

Many borrowers praise SoFi for its transparent fees and helpful customer service. According to Trustpilot, SoFi holds a solid 4.5 out of 5 stars rating based on thousands of reviews ([trustpilot.com](https://www.trustpilot.com/review/sofi.com?utm_source=chatgpt.com)). Customers appreciate the online portal and mobile app, which make loan management easy and convenient.

Important Considerations

- SoFi requires a minimum credit score around 680, so it’s not ideal for those with poor credit.

- Late payments can result in fees and may impact your credit score.

- Prepayment is allowed without penalty, which can save you money if you pay off the loan early.

Conclusion

If you are looking for a trustworthy lender offering low rates, no fees, and flexible terms, SoFi personal loans deserve your consideration. Their online-first approach and borrower-friendly policies make it easier to get the funds you need without surprises.