Diversification for Non-Experts: Simple Ways to Avoid Putting All Eggs in One Basket

In 2001, thousands of Enron employees watched their retirement accounts evaporate overnight. Many had invested their entire 401(k) in Enron stock, believing their employer was invincible. When the company collapsed, they lost not only their jobs but their life savings. This wasn’t a failure of intelligence or diligence—it was a failure of diversification.

The concept sounds simple: don’t put all your money in one place. Yet, most people struggle to implement it correctly. They either over-complicate it with exotic assets, or they think owning five tech stocks counts as “diversified.” This article strips away the jargon and shows you how to build a portfolio that can survive almost anything the market throws at it—without needing a finance degree or a Bloomberg terminal.

Why Concentration Is Dangerous (Even When It Works)

There’s a seductive logic to concentration. If you believe Apple is going to dominate the next decade, why dilute your conviction by owning anything else? If you work in healthcare and understand the industry, why not go all-in on pharmaceutical stocks?

The problem is that individual companies—no matter how dominant—can fail. IBM was once considered the safest stock in America. Kodak invented the digital camera but went bankrupt because they couldn’t pivot. General Electric was a Dow component for over a century before it was removed in 2018.

The Math of Catastrophic Loss

If you own one stock and it drops 50%, you need a 100% gain just to break even. That’s not a typo. A $10,000 investment that drops to $5,000 needs to double to get back to $10,000.

If you own ten stocks and one drops 50%, your portfolio only drops 5% (assuming equal weighting). The other nine stocks cushion the blow. This asymmetry is why diversification isn’t about maximizing gains—it’s about surviving losses.

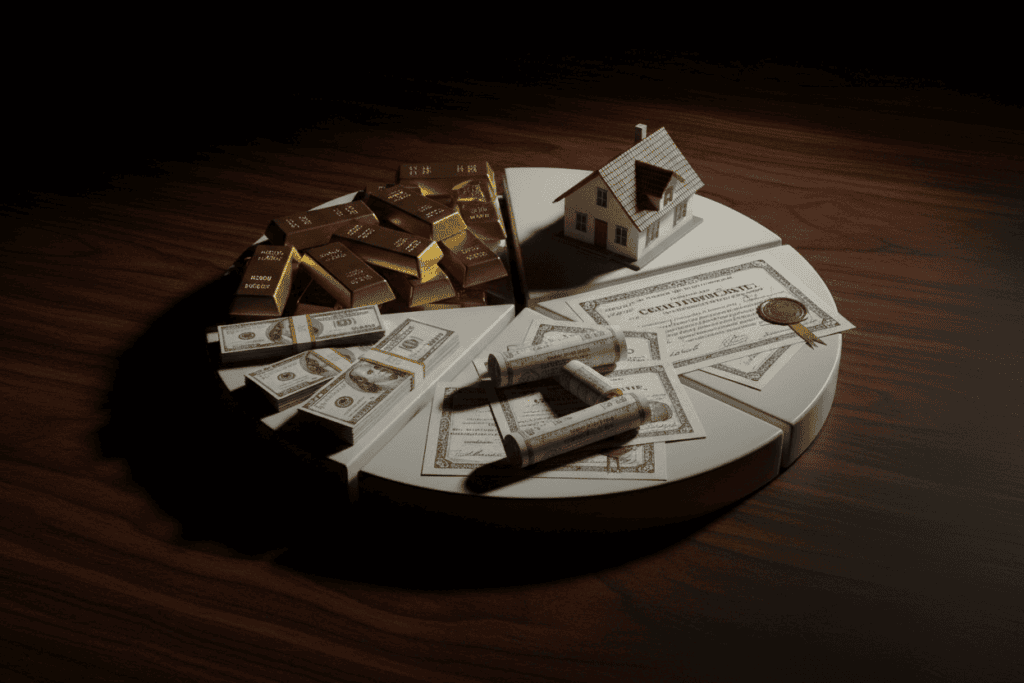

The Three Layers of Diversification

Most people think diversification means “own a bunch of different stocks.” That’s layer one. True protection requires three layers.

Layer 1: Diversification Within Asset Classes

This is the most obvious layer. If you own stocks, own many of them across different sectors.

Bad Diversification:

- 10 tech stocks (Apple, Microsoft, Google, Amazon, Meta, Nvidia, Tesla, Netflix, Adobe, Salesforce)

Good Diversification:

- A total stock market index fund that owns 3,000+ companies across technology, healthcare, energy, financials, consumer goods, industrials, utilities, and real estate.

The first portfolio will get crushed if tech falls out of favor (as it did in 2022). The second portfolio spreads risk across the entire economy.

Layer 2: Diversification Across Asset Classes

Stocks are not the only game in town. Different asset classes behave differently under different economic conditions.

| Asset Class | What It Is | When It Thrives |

| Stocks | Ownership in companies | Economic growth, low interest rates |

| Bonds | Loans to governments/corporations | Recessions, falling interest rates |

| Real Estate | Physical property or REITs | Inflation, population growth |

| Commodities | Gold, oil, agricultural products | Inflation, geopolitical instability |

| Cash | Money market funds, savings accounts | Market crashes (preserves capital) |

When stocks crash, bonds often rise (or at least hold steady). When inflation spikes, real estate and commodities can protect purchasing power. No single asset class is “best” all the time, which is exactly why you need multiple.

Layer 3: Geographic Diversification

The US stock market represents about 60% of global market capitalization. That means 40% of the world’s investable companies are outside the US.

If you only own US stocks, you are making a massive bet that America will continue to outperform the rest of the world forever. That might be true, but it’s not guaranteed. Japan was the dominant market in the 1980s. Then it crashed and spent three decades going nowhere.

Owning international stocks (developed markets like Europe and Japan, plus emerging markets like China, India, and Brazil) ensures that your wealth isn’t tied to the fate of a single country.

Building a Simple, Bulletproof Portfolio

You don’t need 50 different funds to be diversified. In fact, you can build a rock-solid portfolio with just three funds.

The “Three-Fund Portfolio”

This is a classic strategy popularized by the Bogleheads community (followers of Vanguard founder John Bogle). It’s simple, low-cost, and historically effective.

Fund 1: US Total Stock Market Index

- Example: Vanguard Total Stock Market ETF (VTI) or Fidelity Total Market Index Fund (FSKAX)

- What It Does: Owns every publicly traded US company, from Apple to small regional banks.

- Allocation: 60% of your portfolio

Fund 2: International Stock Market Index

- Example: Vanguard Total International Stock ETF (VXUS) or Fidelity International Index Fund (FTIHX)

- What It Does: Owns thousands of companies outside the US.

- Allocation: 20% of your portfolio

Fund 3: US Bond Market Index

- Example: Vanguard Total Bond Market ETF (BND) or Fidelity US Bond Index Fund (FXNAX)

- What It Does: Owns a diversified mix of government and corporate bonds.

- Allocation: 20% of your portfolio

This portfolio gives you exposure to over 10,000 stocks and thousands of bonds across dozens of countries. It’s about as diversified as you can get without hiring a hedge fund manager.

Adjusting for Age and Risk Tolerance

The 60/20/20 split above is a starting point. Your personal allocation should reflect your timeline and stomach for volatility.

Aggressive (Young Investor, 30+ Years to Retirement):

- 80% stocks (50% US, 30% International)

- 20% bonds

Moderate (Mid-Career, 15-20 Years to Retirement):

- 60% stocks (40% US, 20% International)

- 40% bonds

Conservative (Near Retirement, 5-10 Years Out):

- 40% stocks (30% US, 10% International)

- 60% bonds

The closer you are to needing the money, the more you should shift toward bonds and cash to protect against a badly-timed market crash.

Common Diversification Mistakes

Even people who understand the theory often mess up the execution. Here are the traps to avoid.

Mistake 1: “Diworsification”

This is a term coined by Peter Lynch. It means owning so many things that you dilute your returns without actually reducing risk.

If you own 15 different large-cap US stock funds, you don’t have diversification—you have redundancy. They all own the same companies (Apple, Microsoft, Amazon) with slightly different weightings. You are paying multiple expense ratios for the same exposure.

The Fix: Use broad index funds that already contain thousands of holdings. One total market fund is more diversified than ten sector-specific funds.

Mistake 2: Home Country Bias

Americans tend to overweight US stocks. This feels safe because we live here, work here, and understand the companies. But it’s a hidden risk.

If the US dollar weakens, US stocks might underperform international stocks. If US regulations change (think antitrust breakups of big tech), your portfolio takes a direct hit.

The Fix: Aim for at least 20-30% international exposure. It feels uncomfortable at first, but it’s insurance against US-specific risks.

Mistake 3: Ignoring Correlation

Owning stocks and stock options is not diversification—they move together. Owning Bitcoin and Ethereum is not diversification—they are both crypto and will crash together.

True diversification requires assets that don’t move in lockstep. Stocks and bonds have low correlation. Stocks and gold have low correlation. Stocks and other stocks have high correlation.

The Fix: Check the correlation between your holdings. If everything in your portfolio drops 20% on the same day, you are not diversified.

Mistake 4: Rebalancing Too Often (or Never)

Over time, your winners will grow and your losers will shrink. If stocks have a great year, your 60/40 portfolio might drift to 70/30.

Some people rebalance daily, which triggers taxes and trading costs. Others never rebalance, which means they end up taking more risk than they intended.

The Fix: Rebalance once or twice a year. Sell a bit of what went up, buy a bit of what went down. This forces you to “buy low, sell high” automatically.

Real Estate and Alternative Assets

Stocks and bonds are the foundation, but there are other ways to diversify.

Real Estate Investment Trusts (REITs)

You don’t need to buy a rental property to own real estate. REITs are companies that own and operate income-producing properties (apartments, office buildings, shopping malls, warehouses).

They are required by law to pay out 90% of their income as dividends, which makes them attractive for income-focused investors. They also provide a hedge against inflation, since rents tend to rise with prices.

How to Add Them: A REIT index fund like Vanguard Real Estate ETF (VNQ) gives you exposure to hundreds of properties across the US.

Commodities (Gold, Oil, Agriculture)

Commodities are raw materials. They tend to do well when inflation is high or when there’s geopolitical chaos.

Gold, in particular, is often called “crisis insurance.” It doesn’t pay dividends or interest, but it holds value when paper currencies are losing purchasing power.

How to Add Them: A commodity ETF like iShares GSCI Commodity Index Trust (GSG) or a gold ETF like SPDR Gold Shares (GLD).

Warning: Commodities are volatile and can go decades without generating returns. They should be a small slice (5-10%) of your portfolio, not the core.

I Bonds and Treasury Inflation-Protected Securities (TIPS)

These are government bonds that adjust for inflation. If inflation is 5%, your bond’s value increases by 5%.

They are particularly useful during inflationary periods when traditional bonds lose value. You can buy I Bonds directly from TreasuryDirect.gov (up to $10,000 per year per person).

For a deeper understanding of how bonds work and their role in a portfolio, Morningstar’s bond education center offers excellent, unbiased resources.

The Psychological Side of Diversification

Diversification isn’t just a mathematical exercise—it’s a psychological tool.

It Prevents Regret

If you go all-in on one stock and it tanks, you will hate yourself. If you own a diversified portfolio and one holding tanks, you shrug and move on. The emotional difference is massive.

It Reduces the Urge to Time the Market

When you own a little bit of everything, you stop obsessing over whether “now is the right time” to buy. Something in your portfolio is always doing well, and something is always doing poorly. That’s the point.

It Lets You Sleep at Night

The best portfolio is the one you can stick with during a crash. If seeing your account drop 10% makes you panic-sell, you need more bonds. If you can handle a 30% drop without flinching, you can be more aggressive.

Diversification is about building a portfolio that matches your personality, not just your spreadsheet.

Tax-Efficient Diversification

Where you hold your assets matters as much as what you hold.

Tax-Advantaged Accounts (401k, IRA, Roth IRA)

These accounts grow tax-free or tax-deferred. Put your least tax-efficient assets here:

- Bonds (interest is taxed as ordinary income)

- REITs (dividends are taxed as ordinary income)

- Actively managed funds (generate capital gains)

Taxable Brokerage Accounts

Put your most tax-efficient assets here:

- Total stock market index funds (low turnover, qualified dividends)

- Municipal bonds (interest is tax-free)

- Long-term holdings (capital gains taxed at lower rates)

This strategy, called “asset location,” can save you thousands of dollars in taxes over a lifetime.

For more on tax-efficient investing strategies, the IRS’s Investment Income page provides official guidance on how different investments are taxed.

Monitoring Without Obsessing

Diversification doesn’t mean “set it and forget it forever,” but it also doesn’t mean checking your portfolio every day.

Quarterly Check-In:

- Log in once every three months.

- Check if your allocation has drifted more than 5% from your target.

- If yes, rebalance. If no, close the app and go live your life.

Annual Review:

- Once a year, reassess your risk tolerance.

- Are you closer to retirement? Shift toward bonds.

- Did you get a raise? Increase your contributions.

- Did your goals change? Adjust accordingly.

The goal is to stay on track without becoming a day trader.

Conclusion

Protection Over Perfection

Diversification will never give you the highest possible return. There will always be a single stock or asset class that outperforms your diversified portfolio in any given year. That’s fine.

The goal isn’t to beat the market—it’s to participate in the market’s long-term growth without getting wiped out by short-term chaos. Diversification is the difference between building wealth and gambling with it.

Take Action Now:

Open your brokerage account and look at your current holdings. Write down what percentage of your portfolio is in each asset class. If more than 50% is in a single stock, sector, or country, you have work to do. Start by adding a total market index fund with your next contribution. Small steps compound into financial security.